Retail Economics Response – Consumer Prices Index: June 2019

17 July 2019

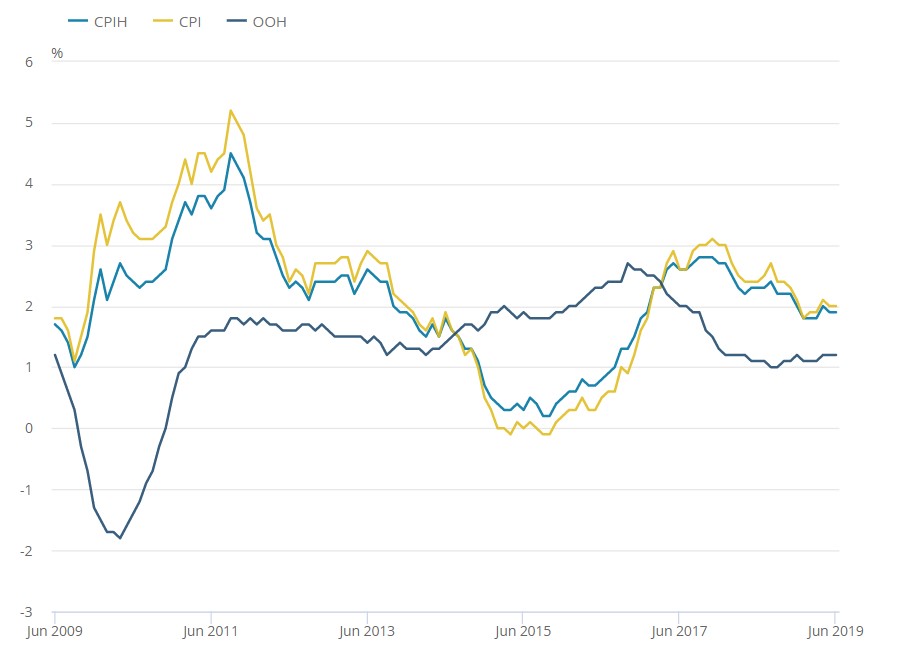

The headline Consumer Price Index (CPI) rose 2.0% in June, year-on-year, unchanged from the previous month and in line with expectations.

The Consumer Prices Index including owner occupiers’ housing costs (CPIH) 12-month inflation also held steady, rising 1.9%, year-on-year.

Meanwhile, both the Retail Price Index (RPI) and RPI (excluding mortgage payments, RPIX) slowed in June, falling to 2.9% and 2.8% respectively.

Pressure in the supply chain continued to ease, with input inflation falling into negative territory for the first time in three years while output inflation slowed to 1.6% - it’s lowest rate since September 2016.

The largest downward contribution to the change in the 12-month CPI rate came from housing and household services where prices rose by 0.2% a year ago compared with little change this year. The ONS noted that some energy providers raised prices in June 2018 which was not replicated in 2019.

Transport also made a large downward contribution, with prices rising 0.4% between May and June this year compared with a 0.8% rise between the same two months a year earlier. The main downward effect came from motor fuels. Indeed petrol prices fell by 0.1 pence per litre between May and June 2019 compared with a rise of 2.7 pence per litre a year ago.

Restaurants and hotels also made a downward contribution, with prices for accommodation services falling this year compared with a rise a year earlier, reversing last month’s upwards contribution.

The largest upward contribution to the change in the CPI rate came from clothing and footwear with prices falling by 2.1% a year ago compared with a 1.0% decline between May and June 2019. It’s worth noting that last year’s drop was the sharpest decline since 2012.

Food also made a large upwards contribution with prices rising this year but falling a year earlier. Elsewhere, non-durable household goods (which sits within the furniture, household equipment and maintenance category) saw prices rise between May and June this year compared with a fall in 2018.

Core inflation (which excludes food and energy prices) reported a slight uptick in June rising, 1.8%, year-on-year, up from the 1.7% rise in the previous month.

With inflation remaining at 2.0%, yesterday’s uplift in average earnings growth means that real earnings are rising at c.1.6%.

Figure 1: CPIH, OOH (owner occupiers’ housing costs) and CPI 12-month inflation rate for the last 10 years: June 2009 to June 2019.

Source: ONS

Full analysis will be provided in the Retail Economics Inflation Report, released this week.