OUTLOOK FOR THE UK RETAIL INDUSTRY 2021 REPORT

Arguably, the retail industry has never faced such intense structural change heading into 2021, as the sector battles the Covid-19 crisis and changes to trading relationships under Brexit.

The impact of Covid-19 will remain inescapable next year. It has led to both temporary and long-term shifts in shopping behaviour. The next year will see certain consumer habits cemented, while others fall away as safety measures ease, leading to creative destruction.

Three underlying trends highlight this:

- The channel shift towards online and local shops

- A transference of spending towards home living

- Lifestyle changes seeing more time spent at home

This is seeing retailers fast track digital integration, using innovation to come up with cunning ways to leverage existing stores to support online sales. For example, Dunelm quickly introduced a contact-free ‘deliver-to-car’ click and collect alternative, while partnerships with third parties such as Deliveroo and Aldi continue to provide a lifeline to those dabbling in e-commerce.

A greater focus indoors has seen home categories outperform in recent months. But continued elevated levels of demand for home furnishings is unsustainable, given that the housing market continues to be dogged by low supply going into the new year.

When shoppers do venture out, they appear to be avoiding historically crowded places, with consumers re-discovering local and out-of-town shopping. In 2020, footfall in city centres was at around half the level of 2019 throughout the summer months as consumers avoided public transport.

With such unsustainable levels of footfall, retailers are reducing their reliance on costly stores. H&M is set to close 250 stores worldwide in 2021, while luxury label Aspinal of London is looking to shutter all its UK stores to move the brand online.

Retailers that are keeping the lights on in shops will be looking at rent reductions, as physical stores fundamentally generate less revenue. As stores move to turnover-based rents, the rebalance of power between retailers and landlords shifts in favour of the former.

Such cost cutting underlines a strong focus on balance sheets to ensure retailers do not burn through cash over the coming months. Unfortunately, fallout in the form of redundancies and administrations is inevitable. Also, the pressure on working capital remains severe. But it also provides an opportunity for M&A activity and retail partnerships.

With the UK’s departure of the European Union (EU), supply chain disruption is also likely to occur with elevated costs (especially for the food and drink sector) and new administration procedures.

Throughout 2021 as industry restructuring unfolds, there will be many opportunities for retailers to watch out for:

- Gaps forming in the market as administrations occur

- Points along the customer journey where relationships can be strengthened

- Engagement of new customer segments online

- Streamlining processes for greater efficiency

- New partnerships to enhance propositions and capabilities

- Innovation between in-store and online for new consumer experiences

- Fostering genuine consumer relationships in challenging times

Harnessing these opportunities effectively requires a deep understanding of all the key factors.

|

Consumer Environment

|

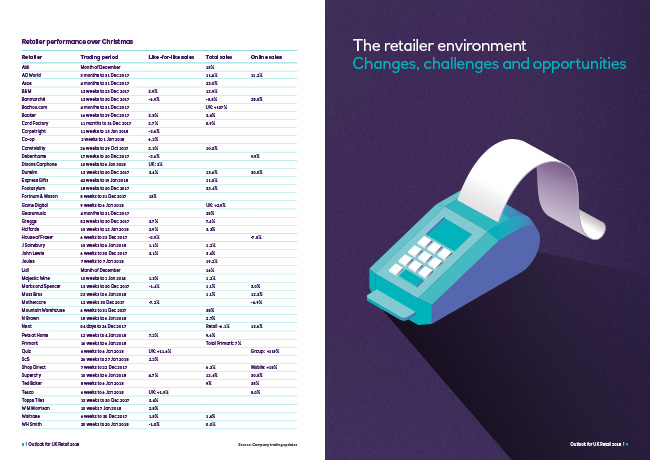

Retailer Environment

|

Our ‘Outlook for UK Retail 2021 Report’ explores these opportunities and many other issues, delving into the necessary detail to help retailers (and retail-related industries) successfully navigate through these unprecedented times.

Subscribe to Retail Economics to keep abreast of the latest developments and understand what this could mean for your business.